Protecting Your Digital Gold: Online Financial Safety in the Modern Age

Dive into the evolving world of online financial security. Understand the importance of strong online practices to safeguard your digital assets and ensure prosperity.

The technological revolution has drastically altered our interaction with money. From a time when physical gold was the standard, we now live in an age where cash is gradually being replaced by digital payments. But as we tread deeper into this digital age, it's essential to acknowledge its infancy and recognize the increasing importance of securing our online financial assets.

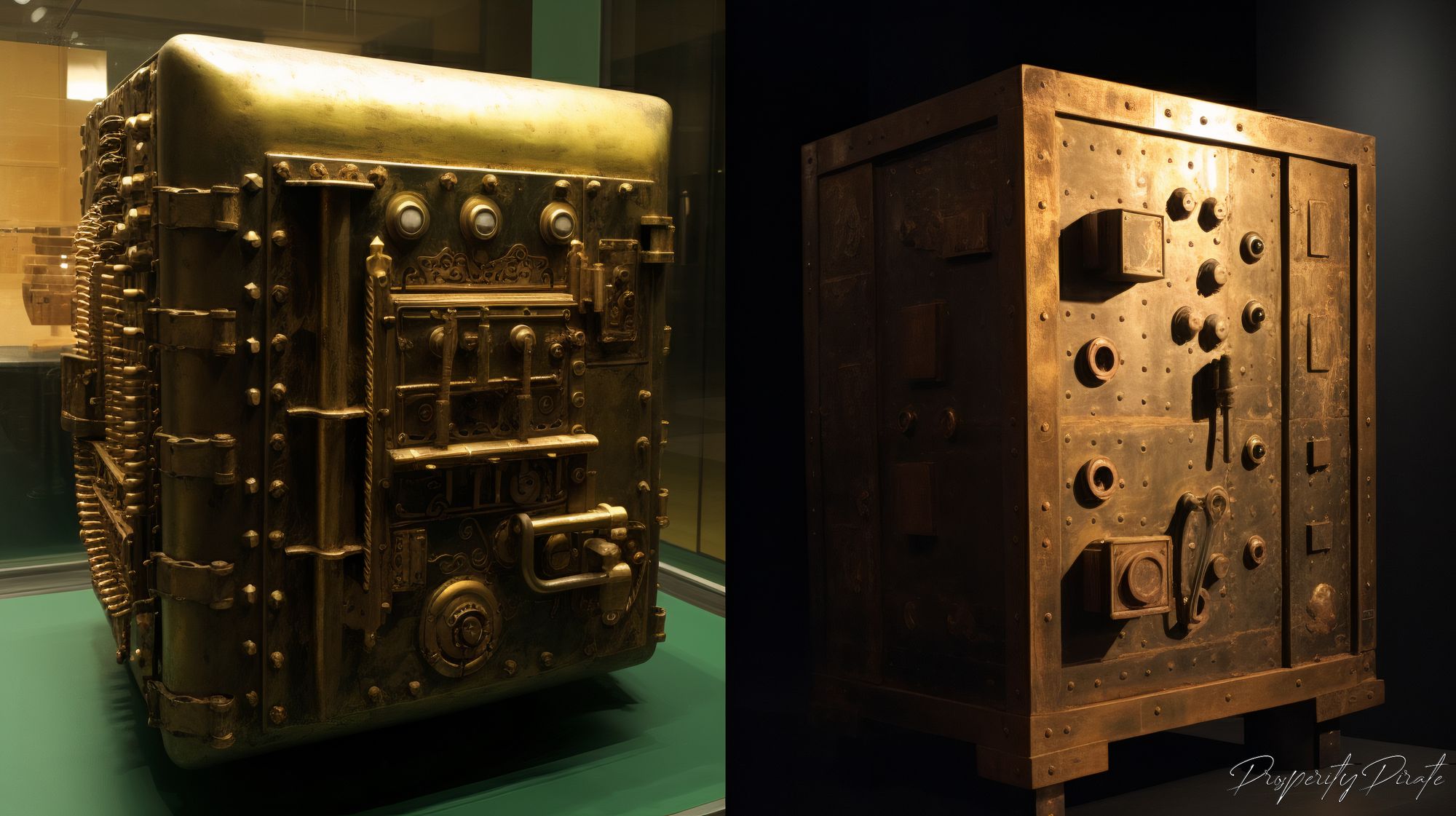

Historically, safeguarding one's wealth was a more tangible task.

Hiding physical gold in a secret location known only to you meant your wealth was safe. Today, that gold has transformed into digital numbers stored in bank databases, making the task of protection much more complex.

Digital safety now hinges predominantly on usernames and passwords, the gatekeepers of our online financial accounts. These simple pieces of information, if fallen into the wrong hands, can wreak havoc on one's financial health. Hence, understanding and implementing robust online security practices becomes paramount.

Major financial institutions are generally equipped with advanced cryptographic measures to ensure the safety of their servers and databases. However, while we have to trust these institutions to do their part, it's crucial to scrutinize smaller banks and companies for their security measures.

Here are actionable steps you can take to bolster your online security posture:

- Unique Usernames: Rather than using your email for all accounts, opt for individual usernames. If one username gets compromised, your other accounts remain secure.

- Distinct Passwords: Every account should have its own password. This ensures that a breach in one institution doesn't endanger your other accounts.

- Embrace 2FA: Two-factor authentication adds an additional layer of security. Any institution not offering 2FA should be a red flag, signaling that they may not prioritize your safety.

A common oversight many commit is opting for short, easily remembered passwords. Moreover, the habit of reusing these passwords across multiple platforms compounds the risk. To mitigate these vulnerabilities, password managers come to the rescue.

Here's a comprehensive guide on the best password managers in 2023.

Understanding a password manager's operations is crucial before fully adopting it. Most modern managers are equipped with browser plugins and phone apps that auto-fill passwords, allowing for the creation of complex and long passwords without the stress of memorization. Additionally, always have a backup plan. Regularly exporting and safely storing your passwords ensures you can recover from any unforeseen mishaps with your password manager.

At ProsperityPirate, our mission revolves around assisting readers in building and preserving wealth. Adopting stringent online safety measures is a foundational step towards this mission. We've witnessed countless financial institutions with lax security measures, and we've made the conscious decision to sever ties with them. We hope that our stance inspires more institutions to prioritize security, and more individuals to demand it.

If you have any questions or feedback, feel free to email us at [email protected]

Stay safe and prosper,

Clark Balan